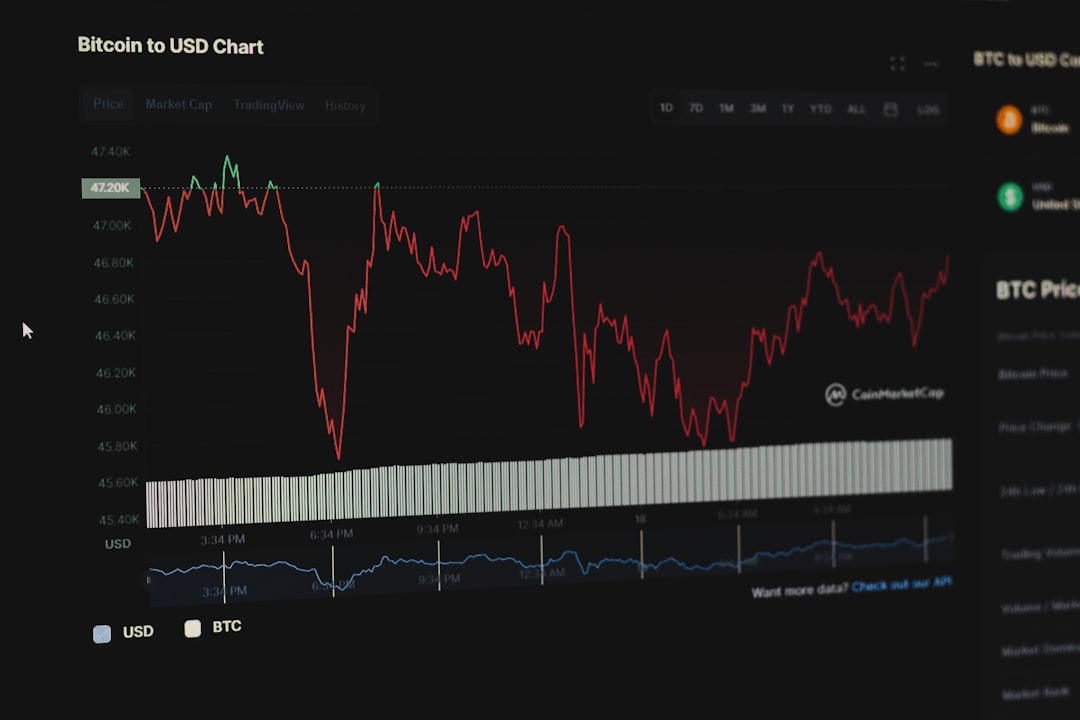

In the highly volatile world of cryptocurrency trading, every edge counts. For U.S.-based crypto traders seeking to maximize profits and minimize risks, an orderbook heatmap may be the key to unlocking a true competitive advantage. While most traders rely on basic charts, candles, and moving averages, the orderbook heatmap provides a real-time visual representation of market depth and liquidity—crucial data often overlooked by retail participants.

Whether you’re trading Bitcoin on Coinbase, Ethereum on Binance US, or any number of altcoins, understanding how orderbook heatmaps can inform your strategy could mean the difference between being just another retail trader or gaining an institutional-like edge. Let’s dive into why every U.S. crypto trader should incorporate this powerful tool into their trading arsenal.

What Is an Orderbook Heatmap?

An orderbook heatmap is a dynamic visual chart that shows the limit buy and sell orders across a range of prices. It translates the raw numerical data that you would typically find on an order book into a color-coded map where darker areas represent larger orders and lighter areas represent fewer or smaller orders. The result is a constantly updating snapshot of market liquidity, helping traders understand key support and resistance levels at a glance.

How Does It Work?

Orderbook heatmaps pull real-time data from a crypto exchange’s public orderbook and create a visualization where:

- Horizontal axis: Represents price levels.

- Vertical axis: Shows time progression.

- Color intensity: Indicates the volume of buy or sell orders at each price point.

For example, a dense red area on the heatmap above the current price is likely a large sell wall, suggesting strong resistance. Conversely, a deep green zone below the price could indicate a significant buy wall—potential support helping to prevent a price drop.

Why Traditional Indicators Are No Longer Enough

Many U.S. traders rely on conventional indicators such as MACD, RSI, and Bollinger Bands. While these tools have their merit, they are inherently lagging indicators. They reflect what has already happened, not what might happen next. The fast-paced and often unpredictable nature of crypto markets makes it crucial to have access to forward-facing data.

This is where an orderbook heatmap shines. By showing you where real money is sitting in the market—ready to jump in and out—it offers a leading indicator that can foretell potential pivots and reversals. When used correctly, this real-time intel gives traders a massive advantage over others operating on delayed signals.

Benefits for U.S. Crypto Traders

Let’s focus on the unique benefits U.S. traders can gain from using an orderbook heatmap:

- Front-run the Crowd: While most retail traders react to price movement, heatmap users can anticipate it. Seeing incoming walls can help you front-run others waiting for confirmation.

- Better Entry and Exit Points: Identify liquidity zones to pinpoint ideal spots to enter or exit a position. This reduces slippage and improves execution quality.

- Risk Management: Visualizing areas of heavy liquidity can serve as your guide to setting more accurate stop-loss and take-profit levels.

- Institutional Insight: Heatmaps reveal big players’ activity. Spotting large orders from institutions gives retail traders the chance to follow the money instead of fighting it.

Examples of Trading Strategies Using a Heatmap

To understand how powerful this tool is, let’s explore a few simple yet effective strategies that U.S. traders can implement using orderbook heatmaps:

Liquidity Bounce

If you spot a large buy wall forming just below the current price, you may anticipate a bounce. This can be an ideal moment to open a long position. Similarly, large sell walls could forecast rejection zones where a short entry may be viable.

Fakeouts and Traps

Sometimes price breaks a key level, only to whip back after hitting a hidden pocket of liquidity. Heatmaps can help you identify when apparent breakouts are more likely to be traps by showing whether real interest exists beyond the level.

Volatility Forecasting

If the orderbook shows liquidity evaporating, prepare for a big move. Market makers often pull orders before volatility events—heatmaps can visualize this ‘liquidity vacuum’ before it plays out.

Popular Tools Offering Orderbook Heatmap Functionality

Luckily, there are several platforms accessible to U.S. traders that offer excellent heatmap functionality:

- TradingLite: Known for advanced orderbook heatmaps and beautiful interface with customizable features.

- TensorCharts: Offers traditional charting along with high-performance heatmaps and footprint charts.

- Bookmap: A more professional-grade tool offering granular data, used heavily by algorithmic and institutional traders.

Though some of these tools come with subscription fees, the insights they provide often justify the cost many times over—especially for serious traders managing significant capital.

How to Interpret Heatmap Signals Effectively

Understanding a heatmap is only effective if you know how to interpret the changes over time. Here are some best practices:

- Observe Spoofing Activity: Watch for large orders that appear and disappear rapidly. These are fake walls designed to manipulate traders.

- Monitor Order Consistency: Orders that remain fixed and substantial signal genuine interest and act like psychological magnets for price movement.

- Track Order Shifts Over Time: Are walls moving closer to price, or drifting away? Moving walls suggest dynamic market adjustment and likely upcoming volatility.

Compliance and Responsibility as a U.S. Trader

U.S. traders must also be mindful of regulations surrounding crypto trading. Tools like heatmaps are completely legal but should be used in concert with responsible trading strategies and comply with platform-specific TOS and SEC guidelines where applicable. Also, be sure your chosen heatmap platform supports U.S.-regulated exchanges like Coinbase, Kraken, or Binance US.

The Future of Heatmaps in the U.S. Crypto Market

As more U.S. traders move toward sophisticated tools and institutional behavior, heatmaps are becoming less of a “checklist bonus” and more of a necessary staple. Algorithmic bots and whales already use similar data models to front-run the naive retail crowd. By embracing this transparency, retail traders decode the same signals and operate on a level playing field.

With artificial intelligence and machine learning integrating into more market tools, future heatmaps could offer predictive overlays, behavioral analytics, and even plan potential market moves with greater precision. The sooner you adapt, the better positioned you’ll be.

Conclusion

In a marketplace as dynamic and competitive as crypto, relying solely on traditional indicators is no longer enough. An orderbook heatmap is not just another chart—it’s a lens into the market’s true intentions. For U.S. traders who want to elevate their trading game, reduce guesswork, and align more closely with institutional strategy, this tool should be at the forefront of their decision-making process.

Integrating orderbook heatmaps into your trading practice won’t guarantee success, but it may give you the insight, timing, and precision needed to stay ahead of the curve. In the end, knowledge isn’t just power—it’s profit.